Introduction

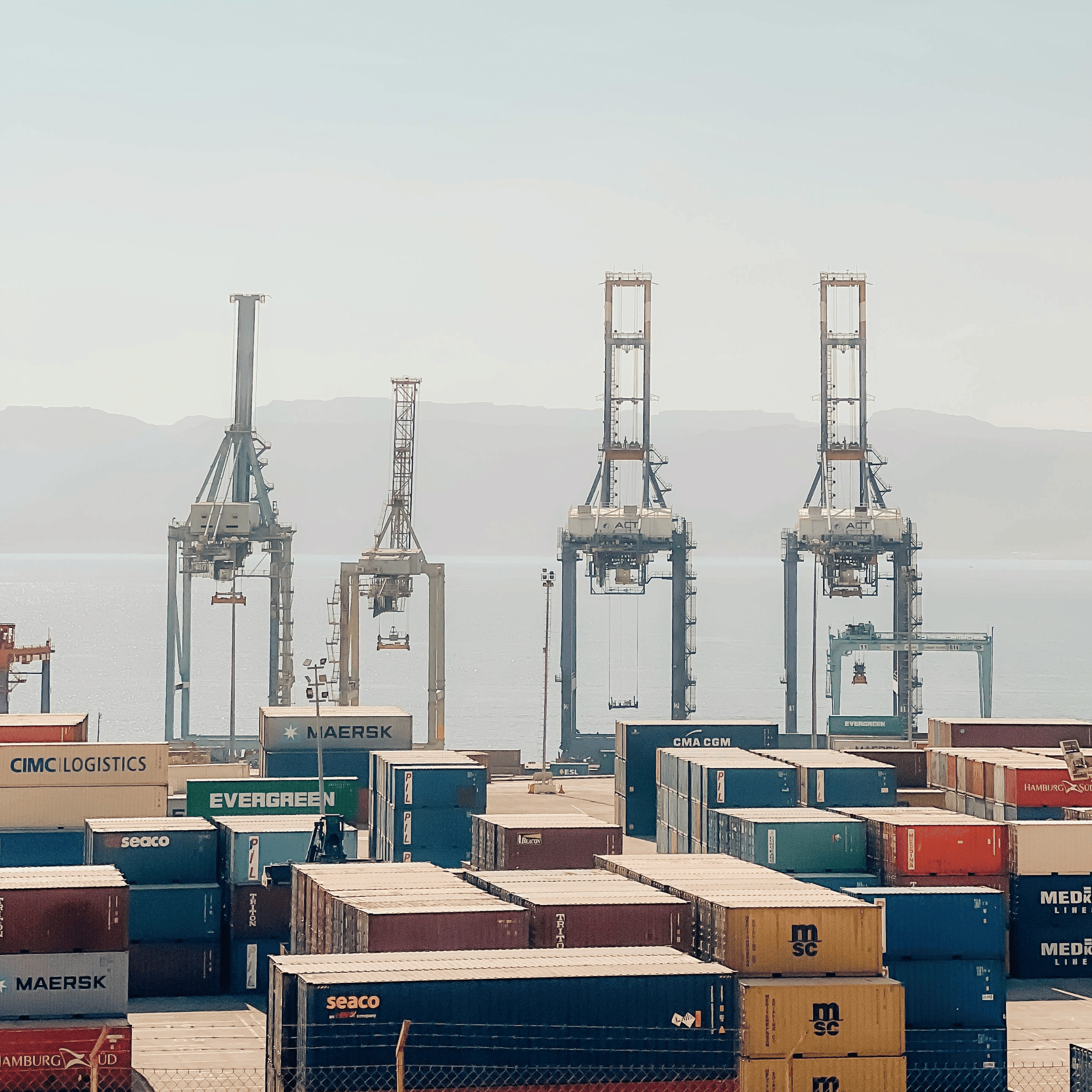

Third-Party Logistics (3PL) providers are essential partners for companies looking to streamline their logistics and distribution processes. As the reliance on 3PL providers increases, so does the importance of understanding and managing risks associated with such partnerships. Insurance plays a vital role in protecting both the 3PL provider and its clients from unforeseen setbacks.

Background

A leading electronics company, ElectronCo (a fictional name), partnered with a 3PL provider, LogiServe (also fictional), to handle its warehousing, distribution, and reverse logistics.

Challenges & Risks

Operational Risks: The chances of logistical errors such as mis-shipments, delayed deliveries, and lost goods.

Contractual Risks: If the terms aren’t clearly defined, ElectronCo could face unexpected costs or poor service levels.

Technological Risks: Dependence on IT systems brings risks of data breaches, system crashes, and inefficiencies.

Environmental Risks: Natural disasters could disrupt the supply chain and damage products.

Financial Risks: If LogiServe runs into financial trouble, it could impact its operational efficiency and reliability.

Regulatory and Compliance Risks: Different countries or states have varying regulations that could affect the transport of goods.

Reputational Risks: Any significant failure by LogiServe reflects directly on ElectronCo.

Risk Management Approaches

Operational Audits: ElectronCo regularly audited LogiServe’s operations to ensure adherence to operational standards.

Clear Contractual Terms: Both companies worked closely to draft contracts, defining responsibilities, performance metrics, and penalties for non-compliance.

Integrated IT Systems: A seamless integration between ElectronCo’s and LogiServe’s systems ensured real-time tracking and reduced chances of mis-shipments.

Backup Plans: LogiServe had backup storage and transportation plans for emergencies.

Financial Assessments: ElectronCo conducted periodic financial health checks of LogiServe.

Regulatory Compliance Teams: Both companies maintained teams to keep up with and ensure compliance with regulatory changes.

The Role of Insurance

Cargo Insurance: Covered potential damages or loss of products during transportation.

Liability Insurance: Protected LogiServe in case of potential lawsuits from damaged or misplaced goods.

Cyber Liability Insurance: Given the dependence on IT, this insurance protected against potential losses from cyberattacks or data breaches.

Business Interruption Insurance: In the event of natural disasters or other significant disruptions, this insurance helped both companies cover losses from halted operations.

Errors and Omissions Insurance: Protected LogiServe from potential lawsuits resulting from mistakes in their service.

Outcome

Thanks to rigorous risk management protocols and a comprehensive insurance strategy:

– ElectronCo could ensure its products were stored, handled, and shipped with minimal disruptions.

– LogiServe, assured by insurance coverage, could focus on operational excellence without the looming threat of significant financial setbacks due to unforeseen incidents.

Lessons Learned

Proactive Approach

Regularly assessing potential risks and updating risk management strategies can save both parties significant time and money.

Open Communication

Both parties should maintain transparent communication to manage expectations and quickly resolve issues.

Insurance is Crucial

While risk management aims to prevent issues, insurance protects businesses when issues do arise.

Conclusion

A partnership with a 3PL provider offers tremendous benefits, but it’s essential to understand and manage the associated risks. A robust risk management strategy coupled with comprehensive insurance coverage can ensure a smooth operation and protect both parties from potential setbacks.